Casual Tips About How To Find Out If I Have An Offset

If you lived in a community property state during the tax year, the irs will divide the joint refund based upon state community property law.

How to find out if i have an offset. If you want the offset to be on hold while you are challenging it, you must file a request for review at the address written in the offset notice by the later of 65 days after the date of the notice or. To find out if your federal tax refund will be offset, you will need to call the bureau of fiscal service directly. This will search the database and let you know if there is an impending offset.

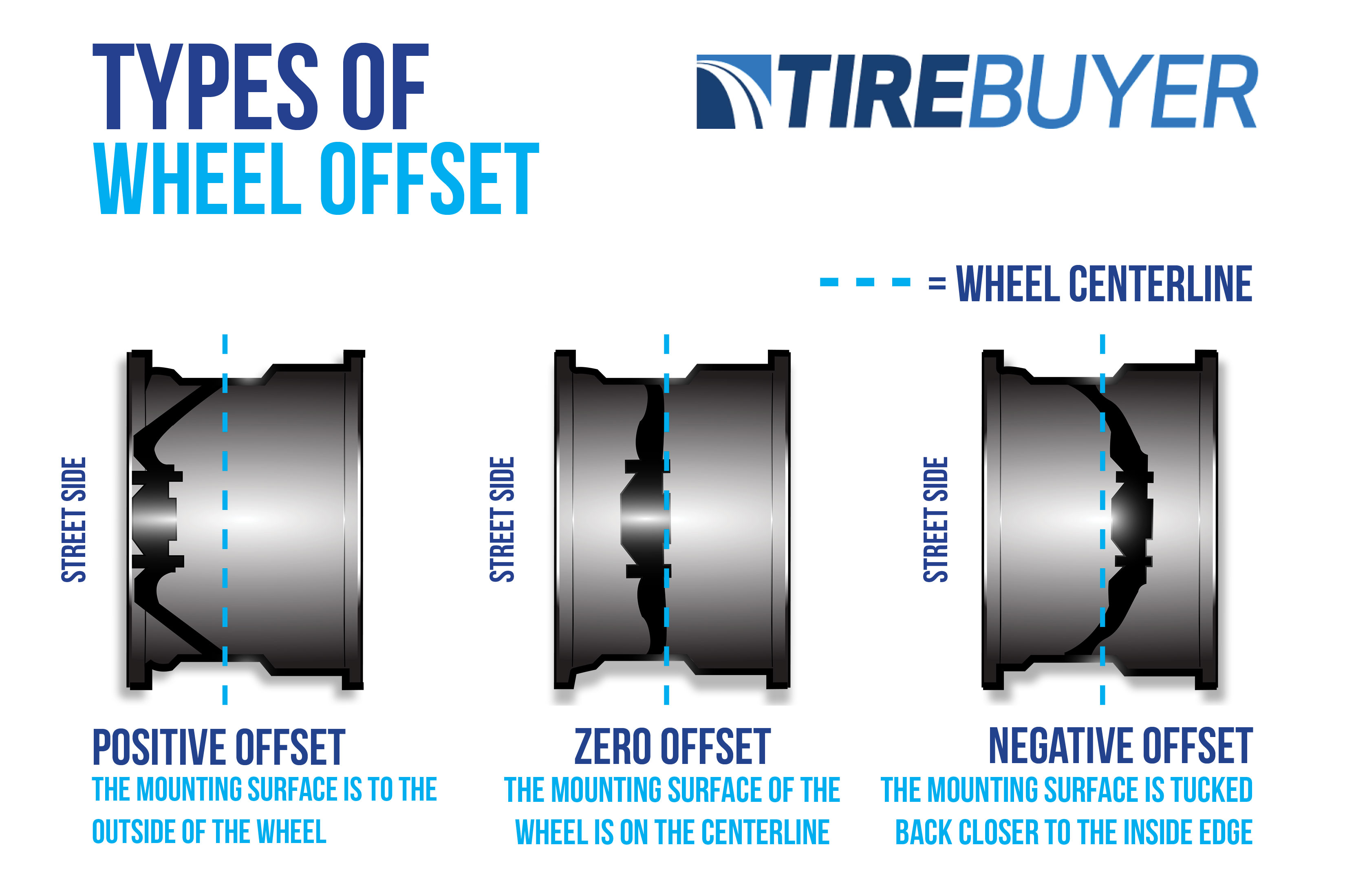

You may not have anyone else call for you, nor. Now all you have to do is continue to wait to see when you will get your refund. The offset function can be used to build a dynamic named range for pivot tables or charts to make sure that the source data is always up to date.

If your debt has been paid in full, or if you do not owe a debt, the. You will need to enter your social security number when prompted by the recording; To find out if your federal tax refund will be offset, you will need to call the bureau of fiscal service directly.

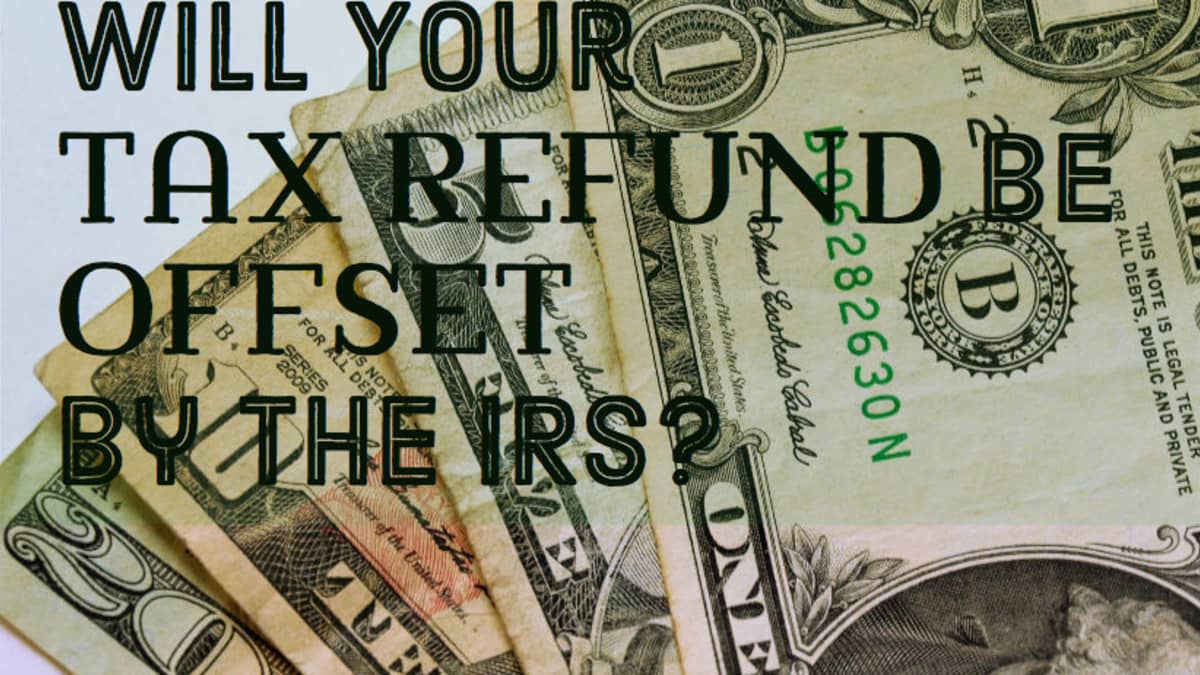

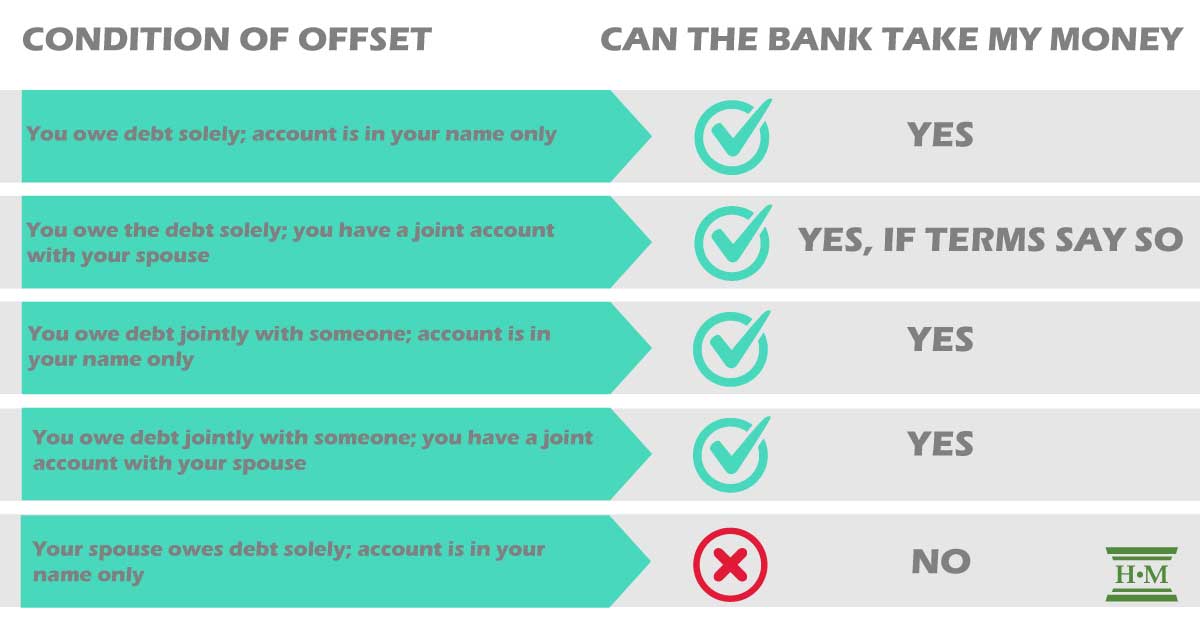

Not all debts are subject to a tax refund. If your tax refund was offset, the irs will tell you why. In most cases, your name can be sent to treasury offset program (top) if your debt is more than 90 days delinquent.

The government agency must determine that your debt is valid and legally. You were accepted meaning they did not find any mistakes etc.

![Need Help! [Math]Calculating Offset For V-Groove, Using Bit ° And Cutting Depth.](https://i.postimg.cc/tRVgWT1R/chamfercalculationneeded.png)